INWIT approves financial statements at 31 december 2023

GROWTH OF ALL INDICATORS, IN LINE WITH THE GUIDANCE

2024-2026 BUSINESS PLAN CONFIRMS GROWTH

AND SHAREHOLDER REMUNERATION

2023: MORE THAN 900 NEW TOWERS, REVENUES UP BY +12.6%,

EBITDAaL BY +16.8%

- 2023 CONSOLIDATED FINANCIAL STATEMENTS CLOSED WITH REVENUES OF 960.3 MILLION EUROS, AN INCREASE OF +12.6% (853.0 MILLION EUROS IN 2022).

- EBITDA AMOUNTED TO 879.2 MILLION EUROS, AN INCREASE OF +12.8% COMPARED TO 2022.

- EBITDAaL AMOUNTED TO 685.6 MILLION EUROS, AN INCREASE OF +16.8 COMPARED TO 2022.

- RECURRING FREE CASH FLOW TOTALLED 611.5 MILLION EUROS, AN INCREASE OF +24.4% COMPARED TO 2022.

- NET PROFIT FOR THE YEAR TOTALLED 5 MILLION EUROS, AN INCREASE OF +15.7% COMPARED TO 2022.

- proposed dividend of 0.48 euros per share, an increase of +38% compared to 2022 in line with the CURRENT dividend policy, with a total of 452.8 million euros to distribute.

- INVESTMENTS IN INFRASTRUCTURE TO SUPPORT OPERATORS FOR 290 MILLION EUROS.

- MAJOR INDUSTRIAL DEVELOPMENT WITH MORE THAN 4,000 NEW HOSTINGS ON INWIT INFRASTRUCTURES AND 905 NEW SITES DEVELOPED DURING THE PERIOD AND APPROXIMATELY 450 DAS COVERAGES FOR INDOOR LOCATIONS OPERATIVE AT END 2023.

- IMPROVED FINANCIAL LEVERAGE AT 8x (4.6X EXCLUDING EFFECT OF BUY-BACK) IN TERMS OF THE RATIO OF NET DEBT TO EBITDA, COMPARED TO 5.2X IN FY 2022.

- Q4 2023 CONFIRMED A SOLID TREND IN FINANCIAL INDICATORS WITH REVENUE GROWTH OF +1% COMPARED TO THE SAME PERIOD OF 2022, REACHING 247.1 MILLION EUROS. MORE THAN 1,000 NEW HOSTINGS AND RECORD OF 315 NEW SITES.

- 2024-2026 BUSINESS PLAN: growth path to 2026 confirmed, in consideration of the DEMAND FOR INFRASTRUCTURES AND GREATER INVESTMENTS MADE IN DEPLOYINGING MACRO AND MICRO GRID COVERAGE.

- 2024 OBJECTIVES: IN AN INDUSTRIAL CONTEXT OF TRANSFORMATION, growth is CONFIRMED of all economic and financial indicators. Revenues are expected to come in between 1,030-1,060 million euros, the EBITDA MARGIN above 91%, the EBITDAaL MARGIN at approximately 73% (up by more than 1 PERCENTAGE POINT COMPARED WITH 2023), RFCF growing in the range of 620-640 million euros.

- THE FIRST INTEGRATED FINANCIAL STATEMENTS AND 2023 NON-FINANCIAL STATEMENT APPROVED.

- SHAREHOLDERS’ MEETING CALLED FOR 23 April 2024, FOR APPROVAL OF THE 2023 FINANCIAL STATEMENTS.

- GENERAL MANAGER DIEGO GALLI: “INWIT CLOSES A YEAR OF STRONG GROWTH DESPITE THE CURRENT CONTEXT OF THE TELECOMMUNICATIONS INDUSTRY, WHICH COULD EVOLVE TOWARDS A MORE SUSTAINABLE MODEL, IN SUPPORT OF GREATER INVESTMENTS. INWIT’S RESILIENCE IS CONFIRMED AS ENABLER OF EFFICIENCY FOR OUR CUSTOMERS: WE CONTINUE TO INVEST IN DIGITAL, SHARED INFRASTRUCTURES WITH A SOLID BUSINESS MODEL, IN SUPPORT OF THE 2024-2026 BUSINESS PLAN GROWTH PATH. PROGRESS CONTINUES ON THE SUSTAINABILITY STRATEGY, IN COMPLETE COHERENCE WITH THE INDUSTRIAL STRATEGY AND WITH A FOCUS ON DIGITALIZATION AND INCLUSION FOR TERRITORIAL DEVELOPMENT”.

Rome, 7 March 2023 – The Board of Directors of Infrastrutture Wireless Italiane S.p.A. (INWIT) met today, chaired by Oscar Cicchetti, and examined and approved the Integrated Financial Statements as at 31 December 2023 which include the annual Financial Statements and the Consolidated Financial Statements as at 31 December 2023.

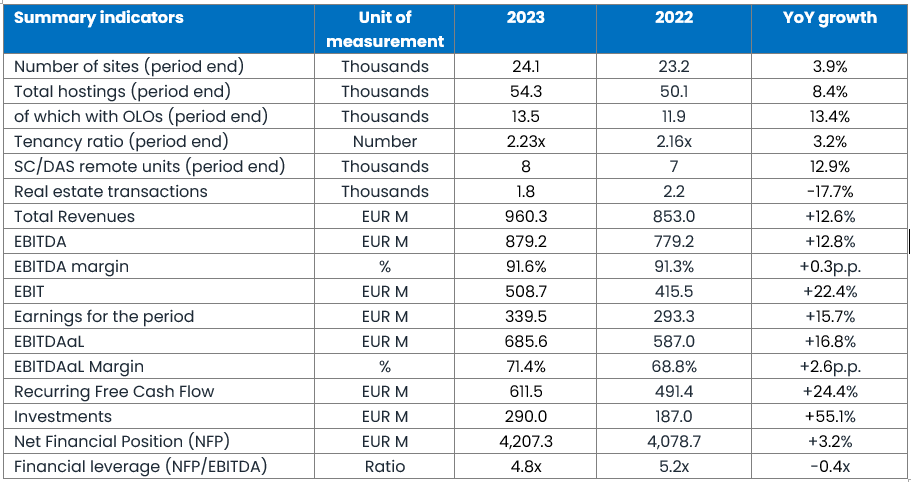

Main results as at 31 December 2023

During the 2023 financial year, all the main industrial, economic and financial indicators increased compared to 2022:

From an industrial point of view, 2023 saw a continuation of the deployment of INWIT’s technological infrastructure:

- extending the number of our sites by 905 new towers;

- continuing to increase new hostings, amounting to over 4,000 for the year;

- extending the plan for multi-operator microcell coverage in the locations with the highest concentration of users and traffic, with approximately 450 DAS coverages for indoor locations at end 2023;

- boosting its efficiency also through its plan to renegotiate rental contracts and purchase land, with more than 1,800 real estate transactions.

At 31 December 2023, the average number of operators per site (tenancy ratio) rose to 2.23 from the 2.16 recorded at end 2022, thereby being confirmed as amongst the highest in the sector.

Main economic-financial results

Revenues stood at 960.3 million euros, up +12.6% compared to 2022 (853.0 million euros), considering the increase in hostings with all the main customers, particularly OLOs, the growth of other services and the deployment of DAS indoor coverage. Growth at +12.6% net of one-off revenues (of 0.6 million euros in 2023 and 2022).

EBITDA stood at 879.2 million euros, up by +12.8% on FY 2022 (+12.4% excluding one-off revenues and costs, with these coming to 2.8 million in the previous year), with a margin on revenues stable at 91.6%, while EBITDAaL, the company’s main profit level indicator, was 685.6 million euros, up +16.8%, thanks to the continuous actions to increase the efficiency of rental costs and the purchase of land. The EBITDAaL margin was up from 68.8% to 71.4% (+2.6 percentage points) as a percentage of revenues.

Net profit for the year totalled 339.5 million euros, an increase of +15.7% compared to 2022.

Recurring free cash flow for FY 2023 came to 611.5 million euros, up +24.4% compared with 2022, as an effect of EBITDA growth and the improvement in net working capital, partly offset by greater outlays for financial charges.

Industrial investments for the period amounted to 290 million euros (+55.1% compared with the previous period), focusing on the Company’s technological and infrastructure development, which included investments in new sites, the activation of new DAS indoor microcell coverage, land purchases and technological improvements of sites.

Net financial debt amounted to 4.2 billion euros, including IFRS16 financial liabilities, an increase of 128.6 million compared to 31 December 2022. The performance reflects the company’s solid cash generation in terms of recurring free cash flow, investments in growth, dividend payments and the purchase of treasury shares for the buy-back plan. Financial leverage, namely the ratio of net debt and EBITDA, is down to 4.8x (4.6x excluding the effect of buy-back) from 5.2x at end 2022, due to the growth of operating margins (EBITDA).

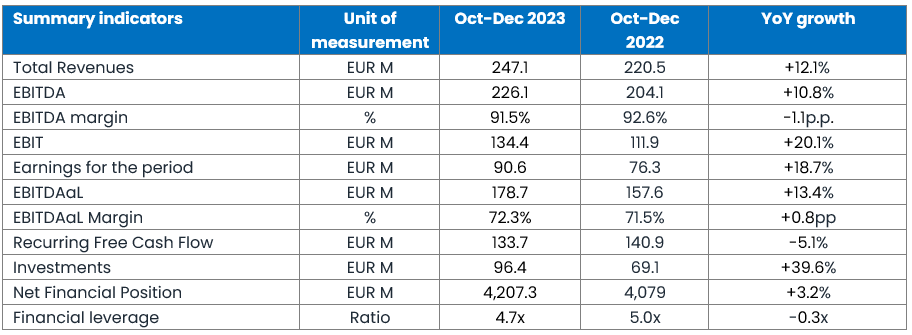

4Q 2023 main results

The results for the fourth quarter of 2023 confirm the continued acceleration in the growth of the main industrial KPIs, revenues and an improvement in profitability and financial leverage.

Q4 2023 saw a continuation of the deployment of INWIT’s technological infrastructure:

- extending the number of our sites by 315 new towers;

- continuing the increase in new hostings, amounting to over 1,000;

- pursuing the plan for multi-operator microcell coverage in the locations with the highest concentration of users and traffic;

- boosting its efficiency also through its plans to renegotiate rental contracts and purchase land with 500 real estate transactions.

Revenues totalled 247.1 million euros, a growth of +12.1% compared to the same period of 2022. EBITDA was 226.1 million euros, an increase of +10.8% on the same period of 2022. This growth, together with greater efficiency in leasing costs, has led to expansion of EBITDAaL, which totalled 178.7 million euros, an increase of +13.4%, and as a percentage of revenue reached +72.3% in Q4 2023, up from +71.5% in Q4 2022.

Net profit totalled 90.6 million euros, up +18.7% compared to the same period of 2022, while Recurring Free Cash Flow amounted to 133.7 million euros (-5.1%). At 31 December 2023, net financial debt came to 4.2 billion euros, of which approximately 1.0 billion euros referred to IFRS16.

Proposed dividend and shareholder remuneration

The Board of Directors passed resolution to propose to the Shareholders’ Meeting payment of a dividend for FY 2023, including the use of part of the available reserves, amounting to 452,810,632.77 million euros. In application of the dividend policy updated at March 2023, this amount considers a 7.5% increase on the 2022 dividend, as well as an additional 100 million euros. Considering the amount of treasury shares held to date by the company, the dividend proposed effectively makes for a dividend of approximately 0.48 euros per share, up 38% on 2022. It is agreed that the dividend per share will be calculated on the actual number of shares outstanding at the date of entitlement (record date 21 May 2024) and therefore excluding the treasury shares held in INWIT’s portfolio. The dividend will be paid on 22 May 2024 (coupon date 20 May 2024).

The proposed dividend is in line with the dividend policy approved by the Board of Directors in November 2020 and March 2023.

As regards additional instruments used to remunerate shareholders, it is confirmed that by end October 2024, the treasury share buy-back plan approved by the shareholders’ meeting in April 2023 and launched in June 2023, will reach completion. After having completed a first tranche of approximately 150 million euros in February 2024, the Company intends to launch, in a similar fashion, the second tranche of the buy-back for up to 150 million euros, subject to the completion of all necessary formalities.

****

Outlook for the 2024 financial year

INWIT is Italy’s most important wireless infrastructure operator, on the strength of the most extensive network of more than 24 thousand macro sites (towers, masts, pylons – macro grids) and 8 thousand micro-cell coverage systems (Distributed Antenna Systems, DAS and small cells – micro grids), assets that assure a capillary, integrated coverage of the territory in support of connectivity, with a “tower as a service” business model in support of all mobile, FWA and IoT operators.

The reference, technological and market scenario for the Tower Companies sector is characterised by positive structural trends, such as the growing use of data on the move, the current technological transition towards 5G, the need to complete and increase the density of coverage, contributing also to reducing the digital divide and the considerable investments made in digital technologies and infrastructures.

These trends result in a growing market demand for new digital infrastructures and hosting services, underlying the Company’s solid growth trend, which has improved continuously in terms of industrial, economic and financial indicators from when it merged with Vodafone Towers in 2020 through to 2023. INWIT’s Business Plan envisages further growth of such indicators through to 2026, supported by a significant investment plan aiming to intercept the increase in demand.

In the short-term, in addition to the significant demand for connectivity, difficulties and strong competition continue to remain on the Italian telecommunications operator market, impacting the profitability of the sector as a whole and its investment capacity. The INWIT business model, which is based on long-term inflation linked hosting contracts, offers protection and support in this context.

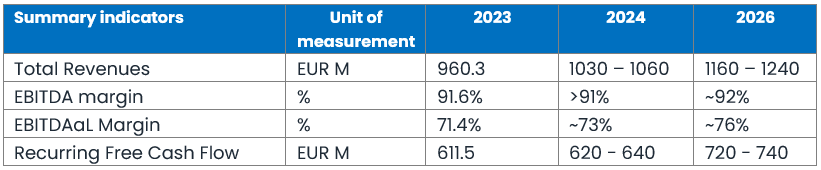

As regards the outlook for financial year 2024, we expect to see:

- growth of revenues in the range of 1.030-1.060 million euros,

- EBITDA margin in excess of 91%, stable compared with 2023,

- EBITDAaL margin of approximately 73%, up more than 1 percentage point compared with 2023 and

- Recurring free cash flow growing in the range of 620-640 million euros.

As regards shareholder remuneration, the policy is confirmed for the period 2023-2026 approved on 2 March 2023, which envisages an increase in dividends and the launch of a share buy-back plan.

2024-2026 Business Plan

The Board of Directors has examined and approved INWIT’s Business Plan for the period 2024-2026 (the “2024 Business Plan”), which confirms the guidelines approved in March 2023 and INWIT’s capacity to invest to develop its infrastructure, developing the main industrial, economic and financial indicators, reflecting the recent evolution of the macroeconomic, industrial and market context.

Reference scenario

In an industrial scenario that is undergoing major transformation, INWIT’s business model enables the country’s digital transition, in support of telecommunication operators and the evolution of the network towards 5G architecture. Another structural driver underlying the greater demand for digital infrastructure services is the constant increase in mobile data consumption: in western Europe, average data consumption per smartphone has gone from 15 GB per month in 2021 to 27 GB in 2023 and is expected to grow by 16% a year through to 2029, when it should reach 64 GB per month[1]. Greater data consumption and need for coverage and densification are just some of the trends underlying the tower market growth in Italy, with a number of macro sites expected to grow from approximately 50 thousand in 2023 to approximately 57 thousand in 2026[2], as well as the need for indoor coverage for more than 3 thousand buildings and coverage for thousands of kms of roads, motorways and rail connections.

2024-2026 targets

INWIT’s market positioning, strengthened by a significant investment plan, makes it possible to pursue some of the industry’s most ambitious growth objectives, according to four main guidelines:

- the partnership with the anchor tenants for an efficient development of 5G;

- the proactive development of business with OLOs, MNO, FWA and others;

- the acceleration of the network of DAS indoor micro-coverages and major projects (e.g. smart city);

- the optimisation of leasing costs, including through a land purchase plan.

In confirming the growth path of the Business Plan approved in March 2023, the 2024-2026 Business Plan envisages revenues growing during the period at an annual average “high-single-digit” rate in the range of 1,160-1,240 million euros in 2026, with an expansion of the EBITDA margin to approximately 92% and of the EBITDAaL margin to around 76%. It is expected that this growth in margins translates into an expansion of cash generation (Recurring Free Cash Flow) in the range of 720-740 million euros in 2026.

[1] Source: Ericsson Mobility Report, November 2023

[2] Source: Altman Solon Report for INWIT

The previous 2026 targets envisaged revenues growing up to more than 1.2 billion euros, with an expansion of the EBITDA margin to approximately 92% and the after-lease EBITDAaL margin to around 76% , in addition to Recurring Free Cash Flow in excess of 730 million euros.

The 2024-2026 Business Plan also envisages investments for a total of around 800 million euros between 2024 and 2026, up approximately 150 million compared with that forecast at March 2023, concentrated in three main areas of intervention: the construction of new sites, the deployment of DAS indoor coverage and the purchase of land.

The EBITDA growth during the plan period is expected to result in a progressive reduction of financial leverage (net debt in respect of EBITDA) from 4.8x at end 2023 to approximately 4.1x in 2026, essentially aligned to the previous financial leverage target (3.5x) having included the increased remuneration of shareholders defined in March 2023, with higher dividends and a treasury share buy-back plan. This trend will progressively make for increased balance sheet flexibility, which could then be used to finance greater investments and/or further increase shareholder remuneration.

The Board of Directors has confirmed the dividend policy approved on 2 March 2023 for the period 2024-2026. 2023 dividend of approximately 0.48 euros per share (payment in 2024), up 7.5% per year through to 2026. By October 2024 the treasury share buy-back plan approved by the shareholders’ meeting in April 2023 and initiated in June 2023, totalling up to 300 million euros, will also be completed.

The Board of Directors has approved, through to 2026, the update of the Sustainability Plan, an integral part of the Business Plan, to make the most of the development opportunities towards the pursuit of sustainable success. The update was driven by an even greater integration of sustainability into business strategy, represented by the concept of “Tower as a service”, structured into the three areas of ESG commitment.

Approval of 2023 Integrated Financial Statements

The Board of Directors has approved INWIT’s first Integrated Financial Statements, containing the sixth Non-Financial Statement (NFS, drafted voluntarily pursuant to Art. 7 of Legislative Decree 254/2016) and the Company’s Annual Financial Report. With the Integrated Financial Statements, INWIT confirms its willingness to offer its stakeholders a complete and integrated vision of its commitment to sustainable success, with the Sustainability Plan being the main driver. The most significant climate initiatives include validation of INWIT’s net zero target for 2040 of CO2 emissions by the Science Based Target initiative (SBTi) and the upgrade of the CDP Climate Change to Leadership level, obtaining a score of A-. In 2023, investments in energy efficiency continued, with the installation of free cooling plants and high efficiency current rectifiers and renewable sources, with an additional 215 photovoltaic plants, taking the total to 349 plants and a total power of 1.4 MW.

With reference to the circular economy approach and management of materials disposed of on sites, the recovery of material is significant, accounting for 98% of the total 1,108 tonnes of waste generated. In 2023, INWIT also took a position on biodiversity through the development of two projects, in a “tower as a service” logic: the project run in collaboration with the WWF Italy to monitor forest fires and the project with Legambiente to monitor air quality in two national parks and two protected areas. Attention to the territory also took concrete form with other projects seeking to reduce the digital divide: the 5G Italy Plan of the NRRP, (INWIT, TIM and Vodafone Italia in a temporary grouping of companies), aiming to foster the deployment of 5G infrastructures in 1,385 disadvantaged market failure areas and the memorandum of understanding signed with UNCEM to support the development of digital services in the country’s inland areas and mountain communities.

People are also key to the sustainability strategy: in 2023, the workforce grew to 296 employees, of whom 39% are women, and UNI PdR 125 certification was obtained for gender equality.

The commitment to activate mobile network coverage projects within high social and cultural vocation structures (such as museums, universities and hospitals) made it possible, in 2023, to have 120 hospital facilities with active DAS (Distributed Antenna System) indoor coverage projects, as well as the M4 Milan underground railway line, which provides 5G connection from Linate airport to the city centre and the coverage of the innovative Milan Lifestyle Center Merlata Bloom, the largest shopping centre of the Lombardy capital.

As confirmation of the validity of INWIT’s route towards implementing a sustainable business model, in 2023 INWIT was once again included in the Bloomberg Gender Equality Index and the FTSE4Good. It has also increased the ESG rating in the GRESB index, going from D to A in just three years and achieved “Prime” status in the ESG rating of ISS, upgrading from D+ to C+.

TCFD Report 2023

The Company has prepared its second TCFD Report, implementing the reporting framework defined by the Task Force on Climate-related Financial Disclosure (TCFD). The aim is to collect clear, comparable information on the impacts of the company’s business on climate and on the effects of climate change on the company.

****

Call of the Shareholders’ Meeting

The Board of Directors has resolved to convene the Shareholders’ Meeting, which will be held exclusively by means of conference call, at a single call for 23 April 2024. The Shareholders can only attend through the Designated Representative, as permitted by Art. 106 of Decree Law no. 18/2020, most recently extended by Decree Law no. 215/2023, converted by Law no. 18 of 23 February 2024.

The Shareholders’ Meeting will be convened to resolve on: (i) approval of the Company’s Annual Financial Statements as at 31 December 2023 and proposed dividend distribution; (ii) report on the 2024 remuneration policy and compensation paid in 2023; (iii) the proposal to supplement the independent auditors’ fees; (iii) conferral of the appointment to perform the external audit of the accounts for the financial years 2024-2032; determination of the fee; (iv) appointment of the members of the Board of Statutory Auditors and the Chairman; determination of their compensation.

The call notice of the Shareholders’ Meeting of 23 April 2024 and all related documents shall be made available to the public – within the terms of the law – on the Company website (https://www.inwit.it/en/governance/shareholders-meeting/) and on the authorised storage platform “1INFO” (www.1Info.it).

Finally, the Board of Statutory Auditors has informed the Board of Directors that it has completed the operational self-assessment process and that, at the meeting held on 12 February 2024, it carried out the checks on the continued fulfilment of the integrity, professionalism and independence requirements of each Statutory Auditor; the Board of Directors has in turn acknowledged this assessment in today’s session.

****

Significant events after the end of FY 2023

No significant events occurred after the end of the financial year.