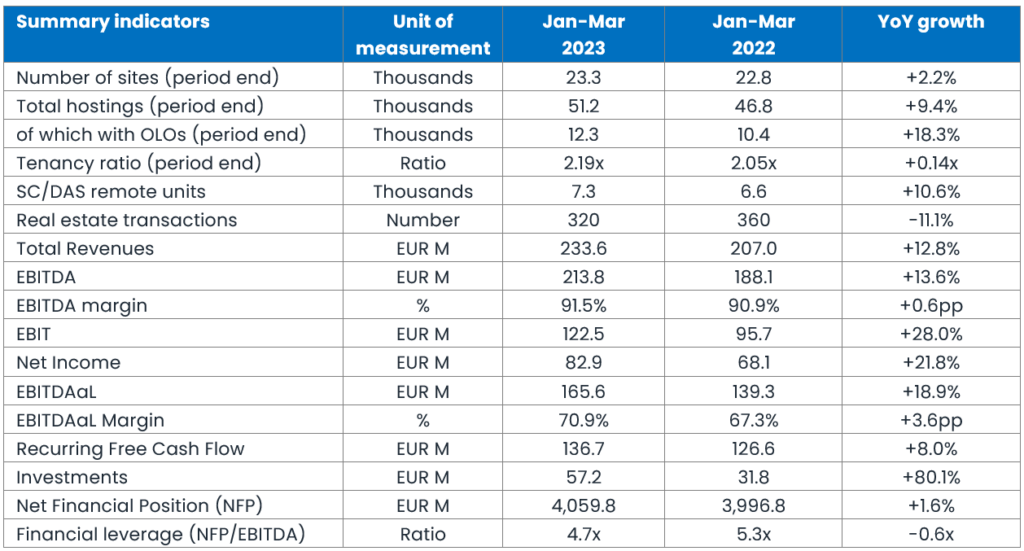

INWIT: Q1 2023 Interim Report approved. Growth trend in investments, industrial KPIS and revenues continues

- REVENUES STOOD AT 233.6 MILLION EUROS, UP BY +12.8% ON THE PREVIOUS YEAR, ALSO THANKS TO THE POSITIVE CONTRIBUTION MADE BY THE ADJUSTMENT OF FEES TO INFLATION.

- EBITDA TOTALLED 213.8 MILLION EUROS, UP BY +13.6% ON THE PREVIOUS YEAR. MARGIN ON REVENUES UP FROM 90.9% TO 91.5%.

- EBITDAaL (EBITDA – LEASING COSTS), THE COMPANY’S MAIN OPERATING MARGIN, STOOD AT 165.6 MILLION EUROS, UP BY +18.9% ON AN ANNUAL BASIS. MARGIN ON REVENUES UP FROM 67.3% TO 70.9%.

- NET PROFITS FOR THE PERIOD STOOD AT 82.9 MILLION EUROS, UP BY +21.8% COMPARED WITH THE PREVIOUS YEAR.

- RECURRING FREE CASH FLOW TOTALLED 136.7 MILLION EUROS, UP BY +8.0% COMPARED TO THE SAME PERIOD OF 2022.

- INFRASTRUCTURE INVESTMENTS IN SUPPORT OF OPERATORS UP BY +80.1%, EQUAL TO 57.2 MILLION EUROS, FOCUSED ON BUILDING NEW SITES, BUYING LAND AND EXPANDING DEDICATED INDOOR COVERAGE.

- INFRASTRUCTURE DEVELOPMENT CONTINUED WITH 130 NEW SITES (MORE THAN DOUBLED YEAR ON YEAR) AND 1,080 NEW HOSTINGS FOR MOBILE, FWA AND OTHER OPERATORS, WITH A TOTAL INCREASE YEAR ON YEAR OF +27.0%. OVER 20 NEW DEDICATED COVERAGE PROJECTS FOR PRIMARY INDOOR LOCATIONS COMPLETED.

- IMPROVED LEVERAGE AT 4.7X IN TERMS OF THE RATIO OF NET DEBT TO EBITDA, COMPARED TO 5.0X IN Q4 2022.

- GENERAL MANAGER DIEGO GALLI: “THE BEGINNING OF 2023 CONFIRMS THE COMPANY’S GROWTH TREND IN SUPPORTING OPERATORS FOR THE EFFICIENT DEPLOYMENT OF 5G, IN ACCORDANCE WITH THE BUSINESS PLAN AND SUSTAINABILITY GOALS. WE REMAIN FOCUSED ON INDUSTRIAL PRIORITIES, FROM SPEEDING UP THE CREATION OF NEW SITES, BOTH IN URBAN ENVIRONMENTS AND IN DIGITAL DIVIDE AREAS, TO DEDICATED INDOOR COVERAGE”.

Rome, 9 May 2023 – The Board of Directors of Infrastrutture Wireless Italiane S.p.A. (INWIT), met today, chaired by Oscar Cicchetti, and examined and approved the Interim Report on Operations as of 31 March 2023.

Q1 2023 main results

The first quarter results confirm the gradual growth in the main industrial KPIs and economic and financial indicators.

Revenue growth in Q1 2023 of +12.8% compared to the previous year, thanks to the increase in hostings for all the main customers, the positive impact of inflation and the development of indoor coverage and new services. Thus the acceleration of INWIT’s organic revenue growth continues, going from+8.7% in the last quarter of 2022 to today’s +12.8%. This growth, together with greater efficiency in leasing costs, which fell compared to Q1 2022, led the EBITDAaL margin to expand by 3.6 percentage points, from 67.3% to 70.9%.

The industrial results show further growth in the number of hostings, the number of new sites and the Tenancy Ratio, which is confirmed as one of the highest in the sector. Approximately 1,080 new hostings, essentially due to the contribution of the anchor customers TIM and Vodafone and the strong growth from other customers; as of 31 March, total new hostings were up by +27.0% year on year. There is continued growth in new dedicated indoor coverage projects, with 20 installed during the quarter, and remote DAS units, with approximately 300 in Q1 2023, as evidence of the growing market interest in dedicated multi-operator cover and with the development of our infrastructure with the creation of 130 new sites.

Main economic and financial indicators

During the first quarter of 2023, all the main economic and financial indicators have shown a positive trend:

- Revenues stood at 233.6 million euros, up +12.8% on the same period of 2022 (207.0 million euros). Net of one-off revenues, limited to 0.2 million euros, the comparison with the same period of 2022 is confirmed as +12.8%;

- EBITDA stood at 213.8 million euros, up by +13.6% on Q1 2022. YoY growth is +13.0% if the specified one-off revenues are excluded, along with non-recurring economic items. The EBITDA margin was substantially stable at 91.5% (+0.2% on a recurring basis);

- EBITDAaL (EBITDA – lease costs), the company’s main operating margin, stood at 165.6 million euros, up +18.9% year-on-year, with a revenue ratio up from 67.3% to 70.9%, considering the decrease in lease costs from 48.9 million euros in Q1 2022 to the current 48.2 million euros, due to the efficiency actions implemented by the Company which more than offset the impact of the asset expansion and inflation.

- EBIT is 122.5 million euros, an increase of +28.0% on the same period of 2022;

- net profits came to 9 million euros, up by +21.8% on the same period of 2022, particularly due to the tax benefit deriving from the tax realignment of goodwill;

- business investments for the period came to 57.2 million euros, up +80.1% (25.4 million euros) on the same period of 2022 (31.8 million euros);

- net cash generation in the first quarter was positive by 18.9 million euros; net financial debt, amounting to 4.1 billion euros (including IFRS16 financial liabilities), was therefore down by -0.5% compared to the figure for December 2022 (4.1 billion euros) as a result of cash generation by the company; financial leverage improved at 4.7x in terms of net debt to EBITDA ratio, compared to 5.0x in Q4 2022;

- recurring free cash flow for Q1 2023 – calculated net of one-off revenues/costs – came to 136.7 million euros, up +8.0% on the same period of 2022, mainly thanks to the growth in EBITDA.

Key Performance Indicators (KPIs)

During this first quarter, INWIT continued to develop its business by:

- increasing the number of hostings on its own sites, 1,080 units;

- developing its infrastructure with the creation of 130 new sites;

- continuing the plan for multi-operator microcell coverage in the locations with the highest concentration of users and traffic, developing around 300 DAS devices and 20 new dedicated indoor coverage projects;

- continuing to improve its efficiency by pursuing the plan to renegotiate rental contracts and purchase land.

As of 31 March 2023, the average number of operators per site (tenancy ratio) is up again at 2.19x, confirmed as amongst the highest in the sector.

****

Information on Russia/Ukraine conflict

With reference to the events relating to the war in Ukraine, the factors that may impact the business performance have been identified and assessed under the scope of the Enterprise Risk Management process. The company constantly monitors the crisis as it unfolds, intensifying its monitoring and risk mitigation measures as may be necessary, also with a view to identifying any impacts that cannot be foreseen to date. In any case, there are no significant effects on the financial statements as at 31 March 2023 or on the outlook for the company’s business.

****

Outlook for the 2023 financial year

INWIT is Italy’s most important wireless infrastructure operator, on the strength of the most extensive network of macro sites (towers, masts, pylons – macro grids) and systems of micro-cell coverage (Distributed Antenna Systems, DAS and small cells – micro grids), assets that assure a capillary, integrated coverage of the territory in support of connectivity, with a “tower as a service” business model in support of all mobile, FWA and IoT operators.

The reference, technological and market scenario for the Tower Companies sector is characterised by positive structural trends, such as the growing use of data on the move, the current technological transition towards 5G, the need to complete and increase the density of coverage, contributing also to reducing the digital divide and the considerable investments made in digital technologies and infrastructures, also supported by the Next Generation EU programme. In the short-term, in addition to the major demand for connectivity, difficulties and strong competition continue to remain on the Italian telecommunications operator market, impacting the profitability of the sector as a whole. The INWIT business model, which is based on long-term inflation linked hosting contracts, offers protection and support in this context.

These trends result in a growing market demand for new infrastructures and hosting services, as well as the activation of innovative services that are allowing TowerCo to transition from real estate assets to actual shared digital infrastructures, spread throughout the territory, connected to the grid, secure and available to all operators. INWIT, therefore, finds itself in an ideal position to play a leading role in the current digital transformation in progress.

After the 2020 merger with Vodafone Towers and completion of the integration activities in 2021, in 2022 INWIT’s industrial and financial results have recorded a greater, more solid growth trend, which is expected to continue this year, through a further improvement of all industrial, economic and financial indicators.

As regards the outlook for the 2023 financial year, we expect to see growth in revenues in the range of 960-980 million euros, an EBITDA margin of approximately 91%, stable on 2022, the EBITDAaL margin of approximately 71%, up by two percentage points on 2022 and Recurring Free Cash Flow up to in the range of 595-605 million euros. In terms of shareholder remuneration, the company’s current dividend policy envisages dividends per share up +7.5% per year through to 2023. These expectations reflect the continuous development of the number of sites, which will be strengthened in 2023, the increased hosting by all the major mobile, FWA and OTMO operators on the market, further development of indoor DAS/micro-grid hosting and the benefits linked to inflation.

****

The economic and financial results of INWIT at 31 March 2023 will be illustrated to the financial community during a conference call scheduled for 9 May 2023 at 6.00 p.m. (CET). Journalists may listen to the conference call, without asking questions, by calling: +39 02 8020927. The presentation to support the conference call will be made available in advance in the Investors section of the company website www.inwit.it.

****

Pursuant to subsection 2, Article 154-bis of the Consolidated Law on Finance, the Manager responsible for preparing the corporate accounting documents, Rafael Giorgio Perrino, has declared that the accounting disclosures contained in this press release correspond to the documentary evidence and the accounting books and records.