Results at 30 June 2023

GROWTH OF ALL MAIN ECONOMIC AND FINANCIAL INDICATORS ACCELERATION ON INFRASTRUCTURE WITH OVER 200 NEW SITES IN SUPPORT OF TELECOMMUNICATIONS OPERATORS, INCLUDING IN DIGITAL DIVIDE AREAS

- REVENUES: IN Q2 2023 THEY CAME TO 237.6 MILLION EUROS, SHOWING GROWTH OF +12.8% COMPARED TO THE SAME PERIOD OF 2022. IN H1 2023 THEY TOTALLED 471.2 MILLION EUROS, SHOWING GROWTH OF +12.8% COMPARED TO H1 2022.

- EBITDAaL (EBITDA – LEASING COSTS): IN Q2 2023, THE COMPANY’S MAIN OPERATING MARGIN TOTALLED 167.6 MILLION EUROS, UP BY +16.7 COMPARED TO THE SAME PERIOD OF FY 2022. IN H1 2023 IT TOTALLED 1 MILLION EUROS, UP +17.8% COMPARED TO H1 2022.

- NET PROFIT: IN Q2 2023 IT TOTALLED8 MILLION EUROS, UP BY +9.3% COMPARED TO THE SAME PERIOD OF 2022. IN H1 2023 IT TOTALLED 163.7 MILLION EUROS, UP BY +15.3% COMPARED TO THE SAME PERIOD OF 2022.

- RECURRING FREE CASH FLOW: IN Q2 IT TOTALLED 186.9 MILLION EUROS, UP BY +84.8% COMPARED TO THE SAME PERIOD OF 2022. IN H1 2023 IT TOTALLED 323.5 MILLION EUROS, UP BY +42.1% COMPARED TO THE SAME PERIOD OF 2022.

- INVESTMENTS: IN Q2 THEY TOTALLED 59.8 MILLION EUROS, UP BY +54.4% COMPARED TO THE PREVIOUS QUARTER. IN H1 2023 INVESTMENTS TOTALLED 117.1 MILLION EUROS, UP BY +66.0% COMPARED THE SAME PERIOD OF 2022.

- IN Q2 THE BUSINESS CONTINUED TO GROW WITH 225 NEW SITES, 1,060 NEW HOSTINGS FOR MOBILE OPERATORS, FWA AND OTHERS.

- NET DEBT: IT TOTALLED 4,339 MILLION EUROS, WITH FINANCIAL LEVERAGE OF 0X UP FROM THE PREVIOUS QUARTER DUE TO THE PAYMENT OF THE DIVIDEND, AMOUNTING TO 329 MILLION EUROS. IMPROVED FINANCIAL LEVERAGE COMPARED TO 30 JUNE 2022 (5.6X).

- DEVELOPMENT CONSISTENT WITH THE TARGETS OF THE BUSINESS AND SUSTAINABILITY PLANS, IN LINE WITH GUIDANCE.

- GENERAL MANAGER DIEGO GALLI: “Q2 2023 CONFIRMS A TREND OF GROWTH OF ALL MAIN ECONOMIC AND FINANCIAL INDICATORS. IN A CONTEXT THAT CONTINUES TO BE CHALLENGING FOR THE TELECOMMUNICATIONS INDUSTRY, THERE IS CONTINUED DEVELOPMENT OF 5G MOBILE NETWORKS, LEVERAGING OUR BUSINESS MODEL BASED ON INVESTMENTS IN DIGITAL AND SHARED INFRASTRUCTURE. INWIT REMAINS FOCUSED ON THE ROLL-OUT OF SITES, BOTH IN URBAN AREAS AND AREAS OF DIGITAL DIVIDE, AS WELL AS ON THE GROWING NEED FOR INDOOR COVERAGE WITH DAS TECHNOLOGY”.

Rome, 26 July 2023 – The Board of Directors of Infrastrutture Wireless Italiane S.p.A. (INWIT) met today, chaired by Oscar Cicchetti, and examined and approved the financial report as of 30 June 2023.

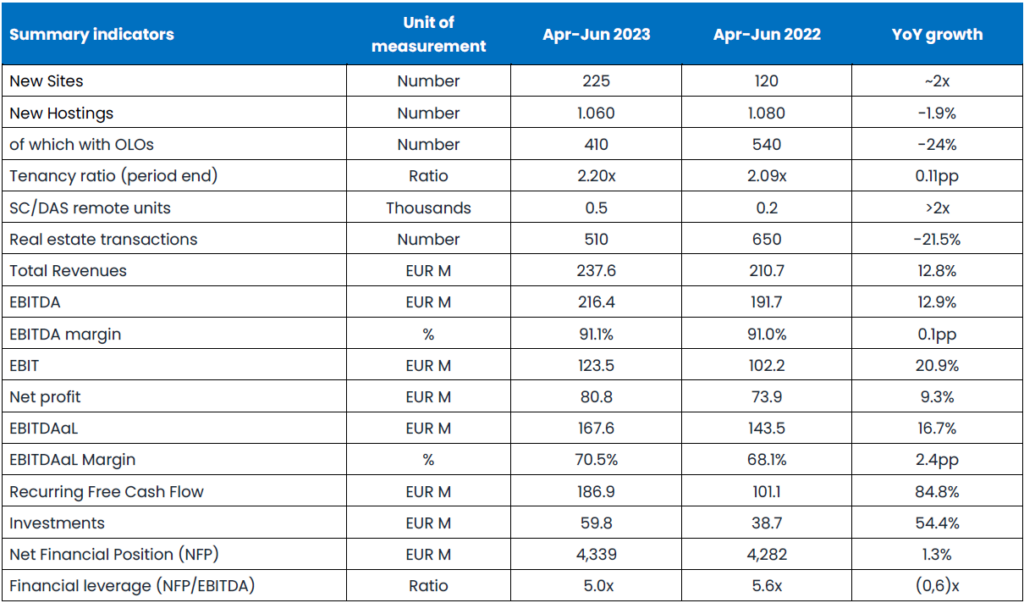

Q2 2023 main results

The results for the second quarter of 2023 confirm the continued acceleration in the growth of the main industrial KPIs, revenues and an improvement in profitability and cash generation.

Q2 2023 saw a continuation of the development of INWIT’s technological infrastructure:

- extending the number of new sites by 225;

- continuing the increase in new hostings, amounting to 1,060;

- continuing the plan for multi-operator indoor coverage in the locations with the highest concentration of users and traffic, developing more than 500 remote units for indoor DAS coverage;

- boosting its efficiency also through its plans to renegotiate rental contracts and purchase land, with 510 real estate transactions.

Revenues totalled 237.6 million euros, an annual growth of +12.8% compared to the same period of 2022. EBITDA was 216.4 million euros, an increase of +12.9% on the same period of 2022. This growth, together with greater efficiency in leasing costs, has led to the expansion of EBITDAaL, which totalled 167.6 million euros, an increase of +16.7%, and as a percentage of revenue reached 70.5% in Q2 2023, up from 68.1% compared to the same period of 2022.

Net profit totalled 80.8 million euros, up +9.3% compared to the same period of 2022, while Recurring Free Cash Flow amounted to 186.9 million euros (+84.8%) compared to the same period of 2022. At 30 June 2023, net financial debt came to 4,339 million euros, of which approximately 1,031 million euros referred to IFRS16. Financial leverage (the ratio of Net Debt to EBITDA) stood at 5.0x, up from the value at the end of March 2023 (4.7x), essentially due to the payment of dividends; INWIT’s gradual deleveraging is evidenced by the reduction in the ratio of Net Debt to EBITDA compared to the end of June 2022 (5.6x).

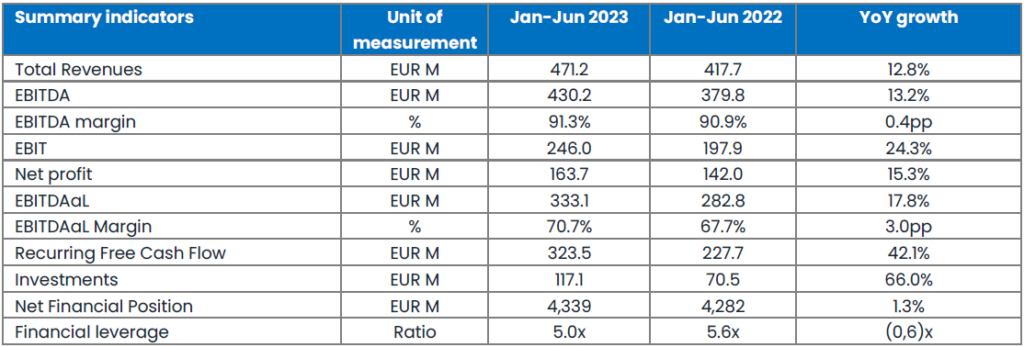

Main results at 30 June 2023

During the first six months of FY 2023, all the main economic and financial indicators have shown growth.

Revenues stood at 471.2 million euros, up +12.8 % on the same period of 2022 (417.7 million euros). The periods in question include one-off revenues for 0.3 million euros. EBITDA was 430.2 million euros, up by +13.2% compared to the same period of 2022. EBITDAaL was 333.1 million euros, up by +17.8% compared to the same period of 2022. Net profit for the period totalled 163.7 million euros, up +15.3% compared to the same period of 2022.

Recurring Free Cash Flow for H1 2023 was 323.5 million euros, up by +42.1% compared to the same period of 2022. Investments for the period came to 117.1 million euros, up 46.5 million euros compared to the same period of 2022 (+66.0%) and were mainly allocated to the development of new sites, of indoor micro-cell coverage with DAS and the acquisition of land.

Plan for merger by incorporation into INWIT S.p.A. of 36 Towers S.r.l

On April 1, 2023, INWIT completed the acquisition of 100% of the shares of 36 TOWERS S.r.l., which operates a total of 36 sites for mobile phone networks located mainly in Piedmont and Lombardy.

Today, among other things, the Board of Directors approved the plan for the merger by incorporation into INWIT of 36 TOWERS, whose share capital is wholly and directly owned by INWIT. The merger plan was also approved on the same date by the Sole Director of 36 TOWERS. The transaction, which provides for the application of the simplifications provided for by the regulations for merger transactions of wholly-owned companies, will not entail any issue of new shares nor any assignment of shares of INWIT, the sole shareholder of the company involved in the merger.

Pursuant to the current regulations, the transaction will be submitted to the Shareholders’ Meeting of 36 TOWERS and to the Board of Directors of INWIT, as allowed by the latter’s bylaws. The merger will make it possible to concentrate the assets in a single entity, centralise the operational activities of the company to be merged in the parent company, and thus reduce administrative, legal, accounting and management obligations.

The transaction benefited of the exemption from the application of the Procedure on Related Party Transactions adopted by the Board of Directors of INWIT, provided for transactions with subsidiaries, pursuant to Article 14, subsection 2, of Consob Regulation no. 17221/2010 and Article 13.4 of the aforementioned Procedure.

Update on the “Italia 5G” Plan of the NRRP

The “Italia 5G” Plan of the NRRP, the programme for the development of new infrastructure in areas of digital divide, is on track to achieve the end-of-year targets. Thanks to careful and effective operational planning, the trend of submitted and already obtained permits continues; the speed and efficiency of the programme is related to the timing of permits and the cooperation of local authorities. In this regard, it is essential for the relevant simplifications adopted by the Government and the Parliament to be fully adopted at local level.

INWIT continues its commitment to representing the value of digital infrastructure in the regions in support of social and industrial transformation, including through close collaboration with institutions and associations representing local communities, as demonstrated by the signing of the Memorandum of Understanding with UNCEM (Italy’s National Union of Mountain Municipalities, Communities and Authorities).

Progress of the Sustainability Plan (2023-2026)

INWIT’s commitment to achieving sustainable success continues, with a focus on its integrated Sustainability Plan, developed around the E (Environment), S (Social) and G (Governance) pillars. It underpins the role of “Tower as a Service”: a shared digital infrastructure that is therefore intrinsically sustainable.

Environment:

- Obtained certification according to ISO 50001, with the objective of optimising energy performance;

- Carried out energy efficiency initiatives with expected savings at full capacity of 4.5 GWh;

- Signed partnerships with Legambiente for air quality monitoring, through the installation of IoT sensors and gateways on several INWIT towers to measure and monitor environmental parameters, and with WWF to automatically detect and promptly alert users of fires spreading in wooded nature reserves, to protect biodiversity.

Social:

- Continued efforts towards the reduction of the digital divide in support of telecommunications operators with over 140 new hostings in socially underdeveloped areas and the signing of a Memorandum with UNCEM;

- INWIT among the first signatories of the Manifesto “Imprese per le Persone e la Società” [Businesses for People and Society] promoted by the UN Global Compact Network Italia, for growing commitment by companies to the social aspect of sustainability.

Governance:

- Published the first INWIT TCFD Report, which describes the management of the risks and opportunities associated with climate change;

- INWIT once again included in the Bloomberg Gender-Equality Index (GEI), and in the Upgraded rating from ISS with achievement of Prime status and from Sustainalytics, Standard Ethics, ISS;

- Survey on “Digital Infrastructure and Italy’s Growth” presented at the third Stakeholder Forum. According to the survey, Italian citizens consider digital infrastructure to be essential for Italy’s harmonious and sustainable growth.

****

Information on Russia/Ukraine conflict

With reference to the events relating to the war in Ukraine, the factors that may impact the business performance have been identified and assessed under the scope of the Enterprise Risk Management process. The company constantly monitors the crisis as it unfolds, intensifying its monitoring and risk mitigation measures as may be necessary, also with a view to identifying any impacts that cannot be foreseen to date. In any case, there are no significant effects on the financial statements as at 30 June 2023 or on the outlook for the company’s business.

****

Outlook for the 2023 financial year

INWIT is Italy’s most important wireless infrastructure operator, on the strength of the most extensive network of macro sites (towers, masts, pylons – macro grids) and systems of micro-cell coverage (Distributed Antenna Systems, DAS and small cells – micro grids), assets that assure a capillary, integrated coverage of the territory in support of connectivity, with a “tower as a service” business model in support of all mobile, FWA and IoT operators.

The reference, technological and market scenario for the Tower Companies sector is characterised by positive structural trends, such as the growing use of data on the move, the current technological transition towards 5G, the need to complete and increase the density of coverage, contributing also to reducing the digital divide and the considerable investments made in digital technologies and infrastructures, also supported by the Next Generation EU programme. In the short-term, in addition to the major demand for connectivity, difficulties and strong competition continue to remain on the Italian telecommunications operator market, impacting the profitability of the sector as a whole. The INWIT business model, which is based on long-term inflation linked hosting contracts, offers protection and support in this context.

These trends result in a growing market demand for new infrastructures and hosting services, as well as the activation of innovative services that are allowing TowerCo to transition from real estate assets to actual shared digital infrastructures, spread throughout the territory, connected to the grid, secure and available to all operators. INWIT, therefore, finds itself in an ideal position to play a leading role in the current digital transformation in progress.

After the 2020 merger with Vodafone Towers and completion of the integration activities in 2021, in 2022 INWIT’s industrial and financial results have recorded a greater, more solid growth trend, which is expected to continue this year, through a further improvement of all industrial, economic and financial indicators.

As regards the outlook for the 2023 financial year, we expect to see growth in revenues in the range of 960-980 million euros, an EBITDA margin of approximately 91%, stable on 2022, an EBITDAaL margin of approximately 71%, up by two percentage points on 2022 and Recurring Free Cash Flow up in the range of 595-605 million euros. In terms of shareholder remuneration, the company’s current dividend policy envisages dividends per share up +7.5% per year through to 2023. These expectations reflect the continuous development of the number of sites, which will be strengthened in 2023, the increased hosting by all the major mobile, FWA and OTMO operators on the market, further development of indoor DAS/micro-grid hosting and the benefits linked to inflation.

****

The economic and financial results of INWIT at 30 June 2023 will be illustrated to the financial community during a conference call scheduled for 26 July 2023 at 6.00 p.m. (CET). Journalists may listen to the conference call, without asking questions, by calling: +39 02 8020927. The presentation to support the conference call will be made available in advance in the Investors section of the company website www.inwit.it.

****

Pursuant to subsection 2, Article 154-bis of the Consolidated Law on Finance, the Executive responsible for preparing the corporate accounting documents, Rafael Giorgio Perrino, has declared that the accounting disclosures contained in this press release correspond to the documentary evidence and the accounting books and records.