INWIT APPROVES FINANCIAL STATEMENTS AT 31 DECEMBER 2024: IMPROVEMENT IN INDUSTRIAL AND FINANCIAL INDICATORS WITH OVER 900 NEW TOWERS, REVENUES +8%, EBITDAaL +9%

2025-2030 BUSINESS PLAN: 1.5 BILLION INVESTMENT IN DIGITAL INFRASTRUCTURE AND EBITDAAL UP +6% CAGR

ORDINARY DIVIDEND OF OVER 480 MILLION EUROS, SPECIAL DIVIDEND OF 200 MILLION EUROS, SHARE BUYBACK OF 400 MILLION EUROS

- CONSOLIDATED REVENUES: 1.036 BILLION EUROS IN 2024, AN INCREASE OF +7.9% (960.3 MILLION EUROS IN 2023).

- EBITDA: 7 MILLION EUROS IN 2024, UP BY +7.7% COMPARED WITH 2023.

- EBITDAaL: 750.3 MILLION EUROS IN 2024, +9.4% COMPARED WITH 2023. EBITDAaL MARGIN AT 72.4% (+1.0pp vs. 2023).

- NET PROFIT: IN 2024 TOTALLED 353.8 MILLION EUROS, UP BY +4.2% COMPARED WITH 2023.

- RECURRING FREE CASH FLOW (RFCF): 621.0 MILLION EUROS IN 2024, AN INCREASE OF +1.6% COMPARED TO 2023.

- PROPOSED ORDINARY DIVIDEND: 5156 EUROS PER SHARE (ABOUT 480.5 MILLION EUROS), +7.5% COMPARED TO 2023.

- INFRASTRUCTURE INVESTMENTS OF APPROXIMATELY 316 MILLION EUROS IN 2024 (+8.9%) WITH OVER 900 NEW TOWERS, OVER 3,700 NEW MOBILE, FWA AND IOT HOSTINGS, AND ABOUT 160 NEW DAS PROJECTS IN PRIME INDOOR LOCATIONS.

- FINANCIAL LEVERAGE (NET DEBT TO EBITDA) AT 4.8X, STABLE COMPARED TO THE END OF 2023.

- Q4 2024 CONFIRMS A SOLID GROWTH TREND WITH REVENUES OF 263.9 MILLION EUROS (+6.8%), EBITDAaL OF 190.7 MILLION EUROS (+6.7%), MORE THAN 900 NEW HOSTS AND 270 NEW TOWERS.

- 2025-2030 BUSINESS PLAN: MEDIUM-TERM GROWTH TRAJECTORY CONFIRMED, DRIVEN BY INCREASING DEMAND FOR DIGITISATION AND BACKED BY SUBSTANTIAL INVESTMENTS IN INFRASTRUCTURE (1.5 BILLION EUROS IN 2025-2030, WITH AROUND 600 MILLION EUROS ALLOCATED FOR 2025-2026). THIS COMES AMID THE ONGOING TRANSFORMATION OF THE TELECOM INDUSTRY AND A PERIOD OF LOW INFLATION. STRENGTHENING OF LEADERSHIP IN TOWERS, STRONG GROWTH IN DEDICATED INDOOR COVERAGE AND IN SMART CITY AND SMART TRANSPORTATION PROJECTS. MAJOR EFFICIENCY PLAN THROUGH THE PURCHASE OF LAND. LAUNCH OF A PROJECT FOR DISTRIBUTED SELF-CONSUMPTION OF SOLAR ENERGY.

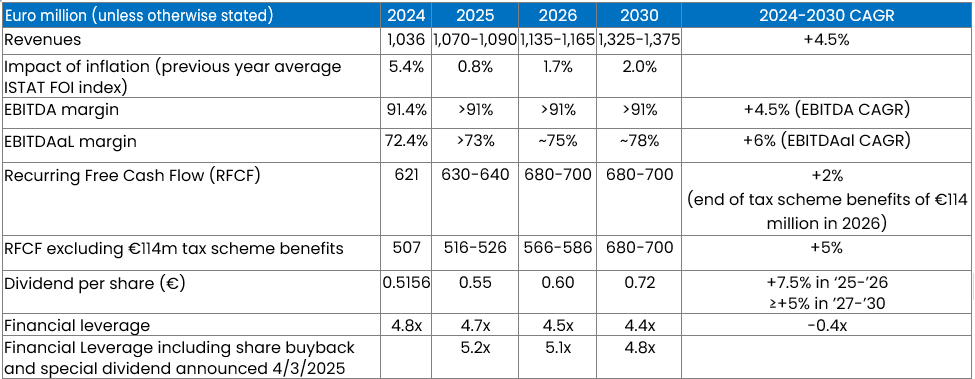

- GUIDANCE FOR 2025-2026-2030: GROWING REVENUES EXPECTED OF BETWEEN 1,070-1,090 MILLION EUROS IN 2025, 1,135-1,165 MILLION IN 2026 AND 1,325-1,375 MILLION IN 2030; EBITDA MARGIN STABLE ABOVE 91%; EBITDAaL MARGIN GROWING TO OVER 73% IN 2025, APPROXIMATELY 75% IN 2026 AND ABOUT 78% IN 2030; RECURRING FREE CASH FLOW EXPECTED TO GROW IN THE RANGE OF 630-640 MILLION EUROS IN 2025, 680-700 MILLION IN 2026, 680-700 MILLION IN 2030 DESPITE THE END OF TAX BENEFITS FROM 2026 ONWARDS, WHICH AMOUNT TO APPROXIMATELY 114 MILLION EUROS PER YEAR; FINANCIAL LEVERAGE EXPECTED TO DECREASE TO 4.7X IN 2025, 4.5X IN 2026 AND 4.4X IN 2030.

- DIVIDENDS AND SHARE BUYBACK: 2025-2026 DIVIDEND POLICY CONFIRMED (ANNUAL DIVIDEND PER SHARE-DPS GROWTH +7.5%); ORDINARY DIVIDEND GROWTH EXTENDED TO 2027-2030 (ANNUAL DPS GROWTH AT LEAST +5%). NEW SHARE BUYBACK PLAN FOR 400 MILLION EUROS WITHIN 12 MONTHS, PROPOSED PAYMENT OF A SPECIAL DIVIDEND OF 0.2147 EUROS PER SHARE FOR APPROXIMATELY 200 MILLION EUROS IN NOVEMBER 2025. INCLUDING THE ABOVE OUTLAYS, FINANCIAL LEVERAGE EXPECTED TO BE 5.2X IN 2025, 5.1X IN 2026 AND 4.8X IN 2030. ADDITIONAL FINANCIAL FLEXIBILITY OF UP TO 1 BILLION EUROS BY 2026 FOR HIGHER INVESTMENTS OR SHAREHOLDER REMUNERATION. TARGET FINANCIAL LEVERAGE CONFIRMED BETWEEN 5 AND 6 TIMES THE RATIO OF NET DEBT TO EBITDA, CONSISTENT WITH THE CURRENT CREDIT RATING PROFILE.

- 2024 INTEGRATED FINANCIAL STATEMENTS APPROVED, ALSO CONTAINING NON-FINANCIAL INFORMATION.

- SHAREHOLDERS’ MEETING CALLED FOR 15 APRIL 2025 TO APPROVE THE 2024 FINANCIAL STATEMENTS.

- GENERAL MANAGER DIEGO GALLI: “INWIT WRAPS UP A YEAR OF SOLID RESULTS AND GROWTH. WE ARE PARTICULARLY PLEASED TO HAVE DELIVERED OVER 900 NEW TOWERS AND ABOUT 160 DAS INDOOR LOCATIONS, PROGRESS ON THE NEXT GEN EU ITALIA 5G PLAN AND MAJOR INFRASTRUCTURE PROJECTS FOR INTEGRATED CONNECTIVITY, SUCH AS THE FIERA MILANO SMART CITY, ROMA 5G AND METRO M4 IN MILAN. THE SIGNIFICANT EXTRAORDINARY TRANSACTIONS IN THE TLC SECTOR HAVE THE POTENTIAL TO RESTORE A HEALTHY MARKET BALANCE AND FACILITATE A NEW INVESTMENT CYCLE. IN THIS CONTEXT, INWIT REAFFIRMS ITS LEADERSHIP, ITS CAPACITY TO INVEST IN INFRASTRUCTURE TO DRIVE THE DEVELOPMENT AND EFFICIENCY OF THE INDUSTRY WITH A 1.5 BILLION EUROS PLAN, AND ITS FOCUS ON RESILIENT GROWTH, FURTHER DIVERSIFYING REVENUE STREAMS AND EXTENDING LAND BUYOUT. BASED ON A SOUND FINANCIAL MODEL, WE PROPOSE A SIGNIFICANT SHAREHOLDER REMUNERATION PLAN. WE ARE READY TO SEIZE FUTURE OPPORTUNITIES, BACKED BY APPROXIMATELY 1 BILLION EUROS OF ADDITIONAL FINANCIAL FLEXIBILITY”.

Rome, 4 March 2025 – The Board of Directors of Infrastrutture Wireless Italiane S.p.A. (INWIT) met today, chaired by Oscar Cicchetti, and examined and approved the Integrated Financial Statements as at 31 December 2024 which include the annual Financial Statements and the Consolidated Financial Statements as at 31 December 2024. Furthermore, the Board of Directors approved the 2025-2030 Business Plan, renewing confidence in General Manager Diego Galli for the execution of the Plan itself.

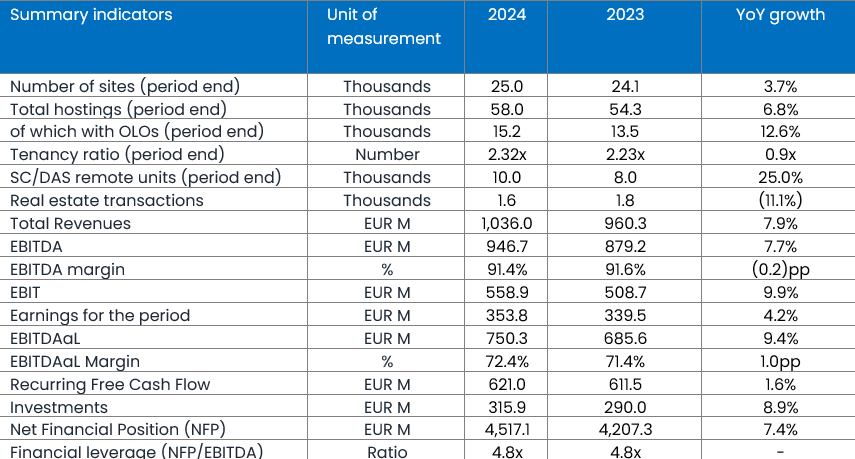

Main results at 31 December 2024

During the 2024 financial year, the industrial, economic and financial indicators increased compared to 2023:

From an industrial point of view, 2024 saw a continuation of the deployment of INWIT’s technological infrastructure:

- expanding our sites by over 900 new towers, totalling 25,000;

- continuing to increase new hostings, amounting to over 3,700 for the year as a whole;

- expanding the plan for dedicated multi-operator coverages in high-traffic, high-user areas, with approximately 160 new DAS coverages for indoor locations, bringing the total to around 610 active DAS coverages by the end of 2024;

- boosting its efficiency also through its plan to renegotiate rental contracts and purchase land, with approximately 1,600 real estate transactions.

At 31 December 2024, the average number of operators per site (tenancy ratio) rose to 2.32 from the 2.23 recorded at end 2023, thereby being confirmed as amongst the highest in the sector in Europe.

Major projects in 2024 include infrastructure projects for integrated 5G connectivity such as Metro 4 Milan, Termini Station in Rome, Borgo Egnazia for the G7, the continuation of the NRRP’s Italy 5G Plan and the launch of Fiera Milano Smart City and Rome 5G.

Main economic-financial results

Revenues stand at 1.036 billion euros, up +7.9% compared to 2023 (960.3 million euros), reflecting the adjustment of hosting contracts to inflation, growth in hosting with all major customers, Anchors and OLOs, as well as growth in other services and the deployment of DAS indoor coverage. Growth at +8.0% net of one-off revenues (0.6 million euros in 2023).

EBITDA stood at 946.7 million euros, up by +7.7% on FY 2023, with a margin on revenues stable at 91.4%, while EBTIDAaL, the company’s main profit level indicator, was 750.3 million euros, up +9.4%, thanks to the continuous actions to increase the efficiency of rental costs and the purchase of lands. The EBITDAaL margin was up from 71.4% to 72.4% as a percentage of revenues.

Net profit for the year totalled 353.8 million euros, an increase of +4.2% compared to 2023.

Recurring free cash flow for FY 2024 came to 621 million euros, up +1.6% compared with 2023, as an effect of EBITDA growth and the improvement in net working capital, partly offset by greater outlays for financial and tax charges.

Industrial investments for the period amounted to approximately 316 million euros (+8.9% year-on-year), focused on the Company’s technological and infrastructural development, which included investments in new sites, the activation of new multi-operator coverages for DAS indoor locations, land purchases and technological site improvements.

Net financial debt amounted to over 4.5 billion euros, including IFRS16 financial liabilities, an increase of 309.8 million compared to 31 December 2023. The performance reflects the company’s solid cash generation in terms of recurring free cash flow, investments in growth, dividend payments and the purchase of treasury shares for the buy-back plan. Financial leverage, namely the ratio of net debt and EBITDA, is stable at 4.8x (4.4x excluding the effect of buy-back and added dividend), due to the growth of operating margin (EBITDA).

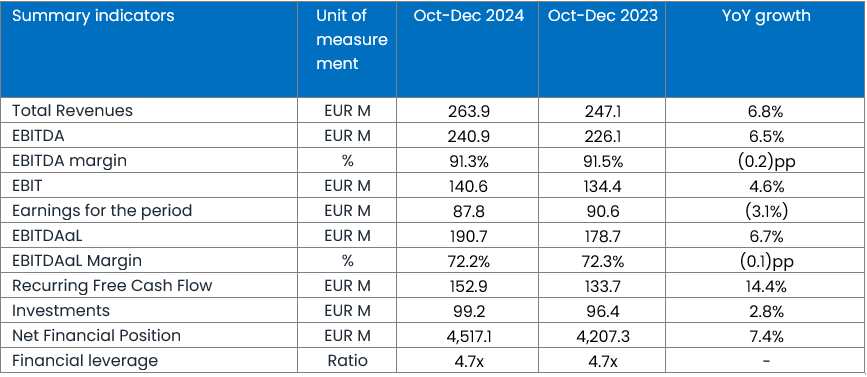

4Q 2024 main results

The results for the fourth quarter of 2024 confirm an improvement in the main industrial and financial KPIs.

Q4 2024 saw a continuation of the deployment of INWIT’s technological infrastructure:

- extending the number of our sites by 270 new towers;

- continuing the increase in new hostings, amounting to over 900;

- continuing the plan of providing dedicated DAS coverages in prime indoor locations, with around 30 new installations;

- boosting its efficiency also through its plan to renegotiate rental contracts and purchase land, with more than 400 real estate transactions.

Revenues totalled 263.9 million euros, a growth of +6.8% compared to the same period of 2023. EBITDA was 240.9 million euros, an increase of +6.5% on the same period of 2023. This growth, together with greater efficiency in leasing costs, has led to expansion of EBITDAaL, which totalled 190.7 million euros, an increase of +6.7%, and as a percentage of revenue reached +72.2% in Q4 2024, (+72.3% in Q4 2023).

Net profit totalled 87.8 million euros, (-3.1% compared to the same period of 2023), while Recurring Free Cash Flow amounted to 152.9 million euros (+14.4%). At 31 December 2024, net financial debt came to over 4.5 billion euros, of which approximately 1.0 billion euros referred to IFRS16.

Proposed dividend for the financial year 2024

In accordance with the company’s dividend policy for the 2024-2026 period, confirmed today, the Board of Directors resolved to propose to the Shareholders’ Meeting the distribution of a dividend for the financial year 2024 that will include the use of part of the available reserves, amounting to 0.5156 euros for each ordinary share outstanding at the record date, an increase of 7.5% compared to the previous year, for a maximum amount of 480,482,489.16 euros. The dividend will be paid on 21 May 2025 (coupon date 19 May 2025 and record date 20 May 2025).

It is specified that, in the event of a change in the number of treasury shares, the unit dividend value will remain unchanged, resulting in a corresponding variation in the total amount distributed as an ordinary dividend.

Please refer to the ‘2025-2030 Business Plan’ section for further information on shareholder remuneration, including the dividend policy for the period 2027-2030, the buyback plan and the proposed extraordinary dividend.

****

Outlook for the 2025 financial year

INWIT is a leading digital infrastructure company and the first Italian tower company. With a network of 25 thousand towers (macro grid) and approximately 610 DAS (Distributed Antenna Systems) coverages for active indoor locations, as well as 10,000 micro-coverage systems (DAS, repeaters and small cells – micro grid), INWIT provides extensive and integrated territorial coverage to support connectivity, with a tower-as-a-service business model supporting all mobile, FWA and IoT operators.

The macroeconomic, technological and market landscape for the Tower Companies sector is shaped by positive structural trends, such as the increasing use of mobile data, the technological shift to 5G and the need to complete and densify coverage across territories. These developments are also helping to reduce the digital divide, supported by significant investments in infrastructure and digital technologies.

In the short term, a rise in demand for connectivity is anticipated, accompanied by modest inflation growth. However, challenges persist in the Italian telecommunications market, including intense competition and limited cash generation, which could affect investment trends. At the same time, there is strong activity in major industrial transactions, which have the potential to restore a healthier market balance and enhance operators’ ability to invest more in digital infrastructure. The INWIT business model, which is based on long-term inflation linked hosting contracts, offers protection and support in this context.

INWIT’s 2025-2030 Business Plan envisages continuous growth across key industrial, economic and financial metrics, underpinned by a substantial investment plan designed to meet the demand for digital infrastructure. The plan also includes a major efficiency initiative, with a focus on land acquisitions to further support expansion.

As regards the outlook for financial year 2025, we expect to see:

- growth of revenues in the range of 1,070-1,090 million euros,

- EBITDA margin above 91%,

- EBITDAaL margin over 73%, up from 2024,

- Recurring free cash flow growing in the range of 630-640 million euros,

- Dividend per share up 7.5% in line with dividend policy,

- financial leverage at 4.7x.

The aforementioned financial metrics do not include the impact of the proposals approved today by the Board of Directors regarding the share buyback plan for 400 million euros and the distribution of an extraordinary dividend of about 200 million euros.

****

2025-2030 Business Plan

The Board of Directors has also examined and approved INWIT’s Business Plan for 2025-2030 (“Business Plan”). The Industrial Plan reflects the current macroeconomic, industrial and market conditions and reaffirms INWIT’s ability to meet the growing demand for digital infrastructure. It focuses on investing in asset development and aims for continuous growth across key industrial, economic and financial indicators.

With investments of approximately 1.5 billion euros from 2025 to 2030 (around 600 million euros in the period 2025-2026), the Business Plan is designed to solidify INWIT’s leadership in towers, foster market growth in indoor coverage and large-scale “smart” infrastructure projects (particularly Smart City and Smart Transportation), enhance cost efficiency through an extensive land acquisition strategy, and introduce a distributed solar energy production and self-consumption initiative.

In terms of financial structure and capital allocation choices, the Business Plan confirms a structural leverage target (ratio of net debt to EBITDA) of 5 to 6 times, with a range of 5 to 5.5 times in the short term. This approach is consistent with INWIT’s current credit rating profile (Investment Grade from Fitch Ratings, BBB- and sub-Investment Grade from S&P Global Ratings, BB+).

Reference scenario

Towers continue to play a central role in the ongoing digitisation trend: they are connected assets, strategically located close to end-users, equipped and shared, offering an efficient solution to operators’ infrastructure needs. The towers are a key part of a broader ecosystem that encompasses active mobile and FWA equipment, outdoor Small Cells, indoor DAS, fibre optic, Wi-Fi, private networks, IoT connectivity, dedicated connectivity for road and rail backbones, and regional and Edge data centres. The growing integration of towers with other digital infrastructure is evidenced by the emergence of large, complex ‘Smart City’ projects which rely on the interaction of multiple technologies. During 2024, INWIT secured several significant new agreements in this market, including Fiera Milano Smart City, Roma 5G, Metro M4 Milan and Roma Termini Station.

Mobile technology is currently transitioning from 4G to 5G. In Italy, significant investment will still be needed to expand coverage, address densification demands and manage growing data usage. Data usage in Italy is expected to continue growing at a double-digit rate until 2030, increasing from 16 to 41 GB per month per user[1] and requiring further investment in the mobile network.

For the Italian market, these trends are expected to result in significant growth in both the number of towers and locations requiring indoor coverage. The number of towers is projected to rise from 53,000 in 2024 to between 60,000 and 65,000 by 2030, while the need for indoor coverage is anticipated to increase from around 3,000 locations today to 5,000 by 2030. The demand for digital infrastructure is set to be driven by the growing need for densification, fuelled by rising data consumption and the rollout of 5G coverage, as well as the need to complete coverage along road, motorway and rail routes. In the medium term, small cells are also expected to grow, complementing macro-sites and DAS indoor coverage.

Growth drivers

Consistent with INWIT’s transformation from a tower company into a digital infrastructure company, the 2025-2030 business plan focuses on the following growth drivers:

- Towers Infra – Rawland and Rooftop Towers

- Smart Infra – DAS, IoT, Small Cells and Large Smart Projects

- Real Estate Infra – Land and self-consumption of renewable energy

The Towers driver aims to solidify INWIT’s leadership as Italy’s top tower company, with plans to roll out approximately 1,500 new sites by 2026 and a total of around 3,500 by 2030. The key drivers of this roll-out plan will be the MSA sites with TIM and Fastweb+Vodafone and the Italia 5G – NRRP plan. From 2027 onwards, the focus will shift to developing sites to meet densification needs, driven by the increasing demand for data. This will be supported by an intensified focus on co-location, with the goal of further increasing the current record of 2.3 tenants per site to 2.4 in 2026 and 2.6 in 2030, serving Mobile, FWA and IoT customers.

On the Smart Infra front, INWIT aims to strengthen its leadership in the development of dedicated coverage for DAS indoor locations, expanding its customer base across both the public and private sectors, with a focus on the large-scale retail trade, hospitality, industrial, large real estate and healthcare sectors. The plan places particular emphasis on large Smart City and Smart Transportation projects (particularly in ports, airports, stations, subways, roads and motorways) that will transform the way people live and use services in our cities. In this context, INWIT’s towers will increasingly integrate with other technologies such as Wi-Fi, IoT and fibre to support innovative services such as smart parking, public space security through smart cameras, consumption monitoring (smart metering), and waste management. The Business Plan builds on INWIT’s recent positive track record in projects such as Fiera Milano, Rome 5G and the coverage of key metro lines and railway stations.

Finally, the 2025-2030 Plan envisages a greater focus on INWIT’s Real Estate assets, according to two main strands. A major land acquisition plan is set to increase the proportion of owned land to over 20% by 2026 and over 30% by 2030. This will significantly reduce lease costs and support the target of an EBITDAaL margin of around 78% by 2030, up from the current 72%. In addition, INWIT is launching a new initiative for the distributed production and self-consumption of solar energy, leveraging its own portfolio of towers and land, as well as MSAs with its customers. This project involves an investment of approximately 100 million euros over the period 2025-2027 with an expected impact on EBITDAaL of more than 10 million euros as of 2028.

Investment Plan

The 2025-2030 Business Plan outlines a significant investment strategy aimed at expanding the company’s infrastructure assets and capitalising on market growth opportunities.

Specifically, investments of approximately 1.5 billion euros are expected in the period 2025-2030, of which around 600 million euros in the two-year period 2025-2026.

Key investments for the 2025-2030 period include:

- construction of new rawland and rooftop towers

- further deployment of smart infrastructure, DAS, IoT and, in the medium term, Small Cells

- increase in land acquisition activity

- launch of a solar energy self-consumption project at owned sites.

INWIT plans to maintain its focus on long-term investment returns, characterized by high visibility, and continues to follow an investment policy targeting an average double-digit percentage (unlevered IRR) return. This approach is designed to support a gradual increase in ROCE (Return on Capital Employed) over time, starting from the current 7.9%.

[1] Source: Omdia

2025-2026-2030 objectives

Confirming the Company’s growth path, the 2025-2026 Business Plan pursues the following objectives:

In summary, operating margins (EBITDA after lease) are expected to continue to grow at an average 6% per annum in the period 2025-2030 supported by:

- adjustment of rents to inflation by 0.8% in 2025 (based on the FOI index of 2024), 1.7% in 2026 and 2027 and 2.0% from 2028 onwards

- approximately 3,500 new towers and around 14,000 new hostings in the period 2025-2030

- tenancy ratio growing to 2.6 customers per site in 2030

- expansion of smart infrastructure (DAS, IoT, small cells), which will account for over 12% of 2030 revenues

- a significant land acquisition plan which underpins the expected expansion of the EBITDAal margin to around 75% in 2026 and about 78% in 2030, from 72.4% in 2024.

Cash generation in terms of Recurring Free Cash Flow (RFCF) is expected to be in the range of 630-640 million euros in 2025 and 680-700 million euros in 2026, including the benefits of a significant goodwill redemption plan, with a cash impact of about 114 million euros per year from 2022 to 2026. Excluding this element, the RFCF would have been 507 million euros in 2024, rising to the 680-700 million euros range in 2030, for an average growth rate of 5% per year.

Dividends and Share Buyback

The Business Plan envisages an improvement in shareholder remuneration, consistent with the reduced level of financial leverage at the end of 2024 (4.8x in terms of the ratio of net debt to EBITDA, compared to a structural target range of 5x-6x and 5x-5.5x in the short term) and INWIT’s business model, based on long-term contracts and high cash flow visibility.

Significant and increasing shareholder remuneration through ordinary dividends is expected. The dividend per share (DPS) is expected to grow by 7.5% per year until 2026 (payment expected in 2027), confirming the previous dividend policy. Thereafter, consistent with the expected growth of the business, the dividend policy is expected to be extended until 2030 with DPS expected to grow at an average annual rate of at least 5% until 2030.

Furthermore, the Board of Directors resolved to propose to the Shareholders’ Meeting the use of two additional shareholder remuneration instruments:

- Share buyback: following the completion of the first 300 million euros plan between 2023 and 2024, a new share buyback plan will be proposed to shareholders for approval. This new plan, also to be carried out in multiple tranches, will have a maximum value of 400 million euros and will be completed within 12 months of the shareholders’ approval. The share buyback plan meets the objective of providing an additional means of remunerating risk capital and increasing earnings and cash flow per share, while limiting any negative effects on the stock’s liquidity. The repurchased shares may be used for cancellation (without reducing share capital), allocation to long-term incentive plans (LTI), or any other uses allowed by law.

The authorisation to purchase treasury shares is requested for the maximum duration required by law of eighteen months from the date of the Shareholder authorisation resolution. The purchases will be made in compliance with the relevant legal provisions, specifically Articles 2357 et seq. of the Italian Civil Code, Article 132 of Legislative Decree No. 58 of 24 February 1998, as well as Regulation (EU) No. 596/2014 and the market practices authorised by Consob.

The buyback may be executed using one or more methods allowed by current regulations, including trading on regulated markets or purchasing blocks of shares.

The minimum purchase price will not be lower than 10% below the official price recorded on the regulated market on the day before each transaction, while the maximum purchase price will not exceed 10% above the official price recorded on the day before each transaction.

Further details on the proposal will be provided in the Board of Directors’ explanatory report, which will be published in accordance with applicable laws and regulations.

- Special Dividend: proposed payment of an extraordinary dividend, in November 2025, amounting to 0.2147 euros per share, for a maximum amount of 200,076,785.15 million euros, from the Company’s distributable reserves. It is specified that, in the event of a change in the number of treasury shares held in the portfolio at the ex-dividend date, the unit dividend value will remain unchanged, resulting in a corresponding variation in the total amount distributed. The distribution of an extraordinary dividend aims to provide an additional monetary benefit to shareholders and rapidly optimise financial leverage by bringing it into the target corridor of 5-5.5x Net Debt / EBITDA. The dividend will be paid on 26 November 2025 (coupon date 24 November 2025 and record date 25 November 2025). From a market perspective, the special dividend is to be considered fully exceptional, as it represents a one-time, non-recurring distribution.

It should be noted that the aforementioned financial objectives do not take into account the economic and financial effects of the aforementioned Share Buyback and extraordinary dividend. Including the Share Buyback and the extraordinary dividend, the projections are for the financial leverage to be approximately 5.2x in 2025, 5.1x in 2026 and 4.8x in 2030.

Besides, given INWIT’s ability to maintain a financial debt ratio (Net Debt / EBITDA) consistently between 5.0x and 6.0x, in line with its current credit rating profile, the company is expected to have approximately 1 billion euros in additional financial flexibility by 2026. This flexibility could be utilised for further investments or shareholder remuneration.

The Board of Directors has approved, through to 2030, the update of the Sustainability Plan, an integral part of the Business Plan, to make the most of the development opportunities towards the pursuit of sustainable success. The update was driven by an even greater integration of sustainability into business strategy, represented by the concept of “Digital Infrastructure Company”, structured into the three areas of ESG commitment.

****

Approval of 2024 Integrated Financial Statements

The Board of Directors has approved the Integrated Financial Statements of INWIT, which includes the Company’s Annual Financial Report and non-financial information. With the Integrated Financial Statements, INWIT confirms its willingness to offer its stakeholders a complete and integrated vision of its commitment to sustainable success, with the Sustainability Plan being the main driver. In 2024, INWIT reaffirmed its commitment to a zero-emission future by publishing its first Climate Transition Plan, which complements and strengthens its climate strategy aimed at achieving Net Zero by 2040. This target has been validated by the Science Based Targets Initiative (SBTi) and aligns with the Paris Agreement’s goal of limiting global warming to 1.5°C. As part of its reduction initiatives, INWIT continued to invest in energy efficiency in 2024, installing free cooling systems and high-efficiency power rectifiers. The company also made significant progress in renewable energy, adding 297 new photovoltaic installations, bringing the total to 646 installations with a combined capacity of over 2.6 MW.

In line with the SBTi initiative’s recommendations for corporate engagement in climate change mitigation that goes hand in hand with the pathway to Net Zero – “Beyond value chain mitigation” (BVCM) -, in 2024 INWIT achieved Carbon Neutrality by offsetting residual Scope 1 and Scope 2 MB emissions through the purchase of certified CO2 credits according to international and quality standards, contributing to the funding of global climate action projects.

With reference to the circular economy approach and management of materials disposed of on sites, the 98% recovery of the more than 800 tonnes of waste generated in total is significant.

In 2024, the commitment to protecting biodiversity continued through forest fire prevention projects, collaborating with organisations like Legambiente and WWF. These projects cover protected oases and protected areas in Abruzzo, Lazio, Molise and Piedmont. To enhance fire detection, smart gateways and cameras were installed on INWIT’s 13 towers in these areas, integrating artificial intelligence software to detect fires at an early stage. In addition, INWIT consolidated its collaboration with Legambiente which began in 2023 to monitor air quality in several parks and reserves in the Central Apennines, including the Abruzzo Lazio e Molise National Park and the Majella National Park. Six telecommunication towers were equipped with IoT sensors and gateways to collect environmental data.

INWIT’s commitment to the territory also extends to initiatives aimed at reducing the digital divide. One key initiative is the Italia 5G Plan – densification of the NRRP, a collaboration between INWIT, TIM, and Vodafone Italia (as a temporary grouping of companies), which focuses on deploying 5G infrastructure in 1,385 under-served market failure areas, with over 200 new sites expected to be built in 2024. To support the deployment of digital services in the country’s inland areas and mountain communities, a memorandum of understanding was signed with UNCEM.

People are also central to the sustainability strategy: in 2024 the workforce grew to 328 employees, 40% of whom are women. The company was also again awarded the TOP Employers certification, recognising its continuous efforts to improve the management, engagement and well-being of its people.

Confirming the validity of INWIT’s commitment to a sustainable business model, in 2024 INWIT became part of the EURONEXT MIB® ESG index for the first time, achieved the maximum score of A in the CDP Climate Change assessment and was recognised by TIME as one of the most sustainable companies in the world.

****

Corporate Governance Issues

The Board of Directors has ascertained that each Director continues to meet the integrity requirements laid down by current legislation.

It also ascertained that the Directors Bariatti, Cavatorta, Guindani, Roseau Landrevot, Ravera, Valsecchi and Favaro, the latter appointed by co-optation on 7 February 2025, meet the independence requirements established by the Consolidated Law on Finance, the Corporate Governance Code for Listed Companies and the qualitative and quantitative criteria used to assess independence, as defined and approved by the Company’s Board of Directors; it also ascertained that the Director Mr Le Cloarec continues to meet the independence requirements laid down by the Consolidated Law on Finance.

The Board of Directors has also approved, on a proposal submitted by the Nomination and Remuneration Committee, the Report on the 2025 remuneration policy and compensation paid in 2024 and the 2024 Report on Corporate Governance and Share Ownership, which reports the outcome of the verification of fulfilment of the independence requirements relating to the Directors and Statutory Auditors, as well as the results of the related self-assessment of the Board of Directors and the Board of Statutory Auditors.

Lastly, the Board of Statutory Auditors has informed the Board of Directors that it has completed the operational self-assessment process and that it has carried out the checks on the continued fulfilment of the integrity, professionalism and independence requirements of each Statutory Auditor; the Board of Directors has in turn acknowledged this assessment in today’s session.

****

Call of the Shareholders’ Meeting

The Board of Directors has resolved to convene the Shareholders’ Meeting, which will be held in Milano at Largo Donegani, 2, at a single call, on 15 April 2025.

The Shareholders’ Meeting will be convened to resolve on: (i) approval of the Company’s Financial Statements as of 31 December 2024 and proposal for the distribution of a dividend; (ii) distribution of an extraordinary dividend;

(iii) purchase and disposal of treasury shares; (iv) report on the 2025 remuneration policy and compensation paid in 2024; (v) appointment of the Board of Directors and determination of their remuneration; (vi) proposal to supplement the independent auditors’ fees; and (vii) advisory vote on the Climate Transition Plan.

The call notice of the Shareholders’ Meeting of 15 April 2025 and all related documents shall be made available to the public – within the terms of the law – on the Company website (https://www.inwit.it/en/governance/shareholders-meeting/) and on the authorised storage platform “1INFO” (www.1Info.it).

****

Significant events after the end of FY 2024

On 29 January 2025 Antonio Corda – non-executive, independent Director – resigned from the office of member of the Board of Directors, for professional reasons. On 7 February 2025, in accordance with Article 13.17, section 1) of the Company Bylaws, the Board of Directors of INWIT appointed by co-option Paolo Favaro as a non-executive, independent director, following the resignation of Antonio Corda.

On February 28, 2025, the European Investment Bank (EIB) and INWIT signed a 350 million euros agreement for the development of digital telecommunications infrastructure. The EIB granted INWIT a loan of 350 million euros to promote the country’s digitalization and connectivity, improving mobile coverage even in the most rural areas. The financing aims to support the development and implementation of macro-grid telecommunications infrastructure (raw land towers and rooftops) dedicated to enabling connectivity for mobile network operators, including 5G, and fixed wireless access (FWA). Investments are also planned for the creation of micro-grid infrastructure, both outdoor, such as small cells, and indoor with multi-operator DAS (Distributed Antenna Systems) coverage, with the goal of enhancing mobile connectivity in environments such as hospitals, museums, shopping malls, subways, and highway tunnels.

Furthermore, with regard to a writ of summons served to INWIT in 2022 for, among other things, alleged breaches of contract, it is confirmed that as of 31 December 2024, no provisions were made to the Provision for Risks and Litigation in relation to this case. This is consistent with the opinion of the external legal advisors assisting the Company in the court proceedings, who assess the likelihood of losing the case as “possible” but not probable. It is also worth noting that on 15 January 2025, the Parties signed a settlement agreement, with each party bearing its own legal costs, and without any admission of liability from either side.

****

The economic and financial results of INWIT at 31 December 2024 will be illustrated to the financial community during a conference call scheduled for 5 March 2025 at 10 a.m. (CET). Journalists may listen to the conference call, without asking questions, by calling: +39 02 8020927. The presentation to support the conference call will be made available in advance in the Investors section of the company website www.inwit.it.

****

Pursuant to subsection 2, Article 154-bis of the Consolidated Law on Finance, the Manager responsible for preparing the corporate accounting documents, Rafael Giorgio Perrino, has declared that the accounting disclosures contained in this press release correspond to the documentary evidence and the accounting books and records.