INWIT’s 2018 Financial Performance

Our 2018 performance exceeded expectations and confirms INWIT’s excellent growth prospects.

Our 2018 performance exceeded expectations and confirms INWIT’s excellent growth prospects. Next up: a Shareholders’ Meeting called for 27 March 2019 for budget approval and conferment of dividends.

2018 demonstrated INWIT’s trend of growth. The company carried out many innovative initiatives to enhance its infrastructural assets and gradually increase its co-tenancy ratio, that is, the average number of customers per site, up to 1.9 customers per tower.

INWIT full achieved its business growth objectives in 2018, ensuring economic and financial performance greater than ‘guidance’ provided by the market

Giovanni Ferigo, INWIT CEO

This past year saw an increase in our efficiency, thanks to a site discontinuation plan, a plan for renegotiating rental contracts and a land acquisition plan.

And that’s not all! We also completed new infrastructure and sped up the process of covering our sites with fiber optics.

More and more connection, more and more innovation

The new year has us already riding the wave of innovation, thanks to the launch of a multi-operator microcellular coverage plan for places with the greatest concentration of users and traffic. This will lead us to work on systems for large railroad stations, airports, hospitals, motorways, stadiums, shopping centers, universities and corporate headquarters.

31 December 2018 Results

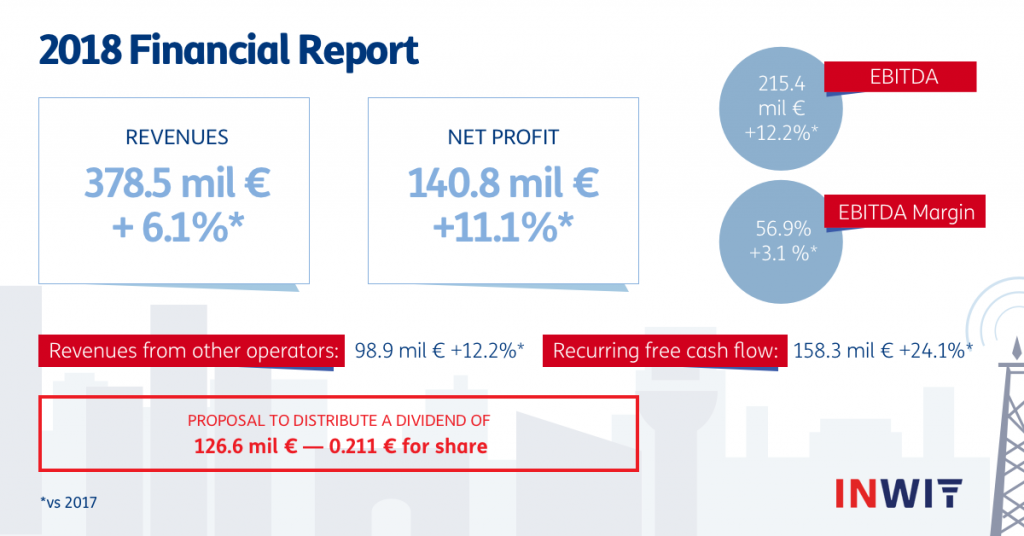

Revenue on 31 December 2018 were equal to 378.5 million euro, 6.1% higher than 2017.

The EBITDA was 215.4 million euro, an increase of 12.2% compared to the previous year, with a margin on revenues of 56.9%, which reflects an increase in tenants on sites, the development of new business and a reduction in the cost of leasing space.

The 2018 EBIT came to 200.3 million euro, an 11.7% increase from the previous year.

Net income amounted to 140.8 million euro, an 11.1% increase from 2017 numbers.

The Recurring Free Cash Flow showed significant growth of 24.1% compared to 31 December 2017, reaching a total amount of 158.3 million euro. In the fourth quarter alone, it was 29 million euro.

Industrial investments on 31 December 2018 were 61.8 million euro, dedicated to the development of the business and new services (small cell, Distributed Antenna Systems, backhauling and new sites), and the purchase of land to reduce rental costs.

Net financial debt at the end of the year was 48.1 million euro, higher than 31 December 2017’s number of 2.7 million euro.

The Shareholders’ Meeting will take place on 27 March 2019 at the Rozzano Auditorium (Milan), to discuss the Budget as of 31 December 2018, the end use of income and the remuneration report.